Background checks are vital for financial employee screening, acting as a shield against fraud and unethical conduct. Comprehensive banking background verification and financial industry compliance checks uncover red flags, ensuring only trustworthy professionals access sensitive data. These measures protect clients, strengthen sector integrity, and prevent malicious actors from engaging in illicit activities, thereby bolstering the security of both investment advisors and bank tellers.

In today’s digital era, financial institutions face heightened risks from fraudsters seeking to exploit vulnerabilities. Background checks play a pivotal role in mitigating these threats, acting as a robust defense against fraudulent activities that can undermine the stability of the financial sector. This article explores the multifaceted impact of background checks in financial services, focusing on employee screening, banking background verification, and compliance checks. We delve into case studies showcasing successful implementation of investment advisor backgrounds to enhance fraud prevention and strengthen financial industry security.

- Understanding the Impact of Fraud in Financial Services

- The Role of Background Checks in Employee Screening

- Key Components of Banking Background Verification

- How Compliance Checks Enhance Financial Industry Security

- Case Studies: Successful Implementation of Investment Advisor Background Checks for Fraud Prevention

Understanding the Impact of Fraud in Financial Services

Fraud in the financial services industry can have devastating effects, leading to significant financial losses, reputational damage, and legal consequences for institutions and individuals alike. With sophisticated methods and ever-evolving schemes, understanding the impact of fraud is paramount in safeguarding the integrity of the financial sector. Background checks play a pivotal role in this regard, offering a robust defense against fraudulent activities.

Financial background verification, including compliance checks for banking, investment advisors, and other industry professionals, helps identify potential risks early on. By delving into an individual’s history, these checks uncover red flags associated with fraud, such as previous offenses, suspicious financial patterns, or unethical behavior. This proactive approach to financial employee screening strengthens the security of the sector, ensuring that only trustworthy individuals gain access to sensitive financial information and transactions.

The Role of Background Checks in Employee Screening

In the financial services sector, where trust and integrity are paramount, background checks play a pivotal role in employee screening. These due diligence measures are essential tools to ensure the security and compliance of the financial industry. By conducting thorough background investigations, institutions can mitigate potential risks associated with fraud, money laundering, and other illicit activities. Every hire, especially those in sensitive roles like investment advisors or bank tellers, requires meticulous scrutiny to prevent any unwanted infiltration.

Banking background verification goes beyond mere identity confirmation; it involves verifying an applicant’s credibility, past employment history, and any red flags that could indicate a higher risk of fraud. Financial industry compliance checks are mandatory to adhere to regulatory standards and protect clients’ assets. This process helps identify individuals with a history of unethical behavior, ensuring they don’t gain access to sensitive financial data. Effective background checks in financial services act as a shield, safeguarding the integrity of transactions and fostering public confidence in the sector.

Key Components of Banking Background Verification

Background Checks in Financial Services play a pivotal role in ensuring the integrity and security of the banking industry. A comprehensive banking background verification process involves several key components designed to mitigate fraud risks. Firstly, thorough employee screening includes verifying employment history, checking references, and conducting extensive identity checks to confirm the authenticity of each financial professional. This step is crucial for identifying any red flags or discrepancies that could indicate potential fraudulent activities or unethical behavior.

Secondly, financial industry compliance checks involve scrutinizing an individual’s past interactions with regulatory bodies, such as securities authorities or consumer protection agencies. By examining reports and records related to previous employment in the financial sector, these checks help identify individuals who may pose a higher risk due to their history of non-compliance or disciplinary actions. Moreover, investment advisor background investigations should also include a review of any professional certifications, licenses, and ongoing educational requirements to ensure they remain current and legitimate, enhancing fraud prevention in finance.

How Compliance Checks Enhance Financial Industry Security

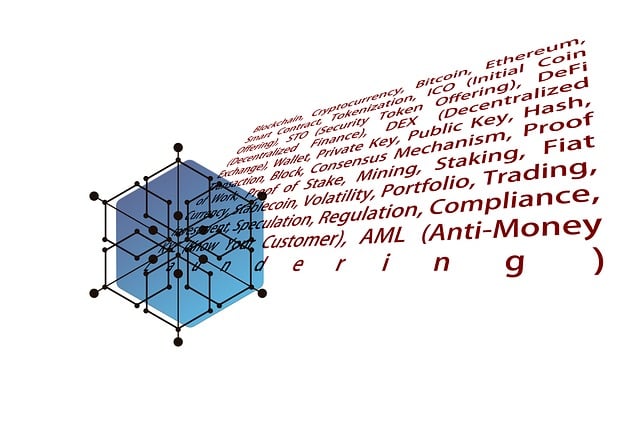

Background Checks in Financial Services play a pivotal role in enhancing the overall security of the banking and investment sectors. By conducting thorough employee screening, institutions can mitigate risks associated with fraud and corruption. These checks involve verifying the identity, work history, education, and any potential red flags in an individual’s background before they are granted access to sensitive financial information. This process is crucial for maintaining the integrity of the financial industry, as it helps identify individuals who may pose a threat due to previous criminal activities, ethical lapses, or untrustworthy behavior.

Financial industry compliance checks extend beyond basic verification. They involve screening for any links to money laundering, terrorism financing, or other illicit activities. Investment advisors, for instance, require meticulous background scrutiny to ensure they meet the highest standards of integrity and professionalism. These measures not only protect the interests of clients but also contribute to fraud prevention in finance by creating a robust defense mechanism against malicious actors who might exploit vulnerabilities within the financial sector.

Case Studies: Successful Implementation of Investment Advisor Background Checks for Fraud Prevention

In recent years, numerous case studies have highlighted the successful implementation of thorough background checks as a powerful tool against fraud within the financial services sector. These checks, encompassing financial employee screening, banking background verification, and compliance checks for investment advisors, have demonstrably lowered risk levels across various institutions. A prominent example involves a leading asset management firm that rigorously vetted its investment advisors through comprehensive background investigations. This proactive measure led to the identification of several potential red flags, enabling the firm to prevent fraudulent activities before they could cause significant damage.

The process involved meticulous scrutiny of criminal records, financial history, and previous employment verifications. By implementing such financial industry compliance checks, the company not only bolstered its reputation but also protected its clients’ interests. This case study underscores the critical role that background checks in financial services play in maintaining security and integrity within the industry. As fraudsters continually adapt their tactics, staying ahead through rigorous screening procedures is essential to safeguarding both institutions and individuals alike.