Background checks in financial services are crucial for maintaining integrity and trust within the industry. Comprehensive screening involves evaluating education, work history, and past convictions to identify potential risks, including insider threats, money laundering, and fraud. Robust financial industry compliance checks, such as banking background verification and investment advisor qualifications, prevent misconduct, fulfill regulatory obligations, and protect clients in both traditional and digital banking environments. Integrating diverse verification methods provides a holistic view of applicants' histories, safeguarding the financial sector and maintaining public trust.

In today’s digital era, ensuring the integrity of the financial sector is paramount. Screening for past convictions among financial professionals is a vital component of comprehensive background checks, crucial for both regulatory compliance and protecting clients from potential fraud. This article explores key aspects of banking background verification, compliance checks for investment advisors, and best practices to safeguard the financial industry from fraudulent activities. Discover how these measures enhance overall sector security.

- Understanding the Importance of Financial Employee Screening

- Key Aspects of Banking Background Verification

- Compliance Checks for the Investment Advisory Sector

- Preventing Fraud: A Crucial Element in Financial Sector Security

- Best Practices for Comprehensive Financial Industry Background Checks

Understanding the Importance of Financial Employee Screening

In the world of financial services, where trust and integrity are paramount, background checks in financial services play a crucial role in maintaining industry security and client protection. Financial employee screening is an essential process that helps identify potential risks associated with hiring individuals for roles dealing with sensitive financial data and transactions. These checks go beyond traditional employment verification to uncover past convictions, legal issues, or unethical behaviour that could impact the integrity of the financial sector.

By conducting thorough banking background verification and compliance checks, employers can mitigate fraud prevention in finance and ensure that investment advisors maintain the highest standards of professionalism. Financial industry compliance heavily relies on these measures to safeguard clients’ assets and maintain public trust. Effective financial employee screening is a game-changer, revolutionizing hiring practices and ensuring that the financial landscape remains robust, secure, and transparent.

Key Aspects of Banking Background Verification

Background Checks in Financial Services are a critical component of ensuring integrity and trust within the industry. When verifying the background of banking professionals, several key aspects come into play to safeguard against potential risks and maintain compliance. Financial employee screening involves an in-depth examination of an individual’s history, including their education, work experience, and most significantly, any past convictions or legal issues. This process is crucial for identifying red flags that may impact a financial advisor’s credibility and ability to serve clients effectively.

Banks and investment firms conduct comprehensive banking background verification to prevent fraud and maintain the security of their operations. These checks go beyond simple identity verification; they include verifying employment history, cross-referencing personal and professional references, and reviewing any public records related to criminal activities or regulatory sanctions. By implementing robust financial industry compliance checks, institutions can mitigate risks associated with insider threats, money laundering, and other illicit activities, ensuring a safer environment for both employees and clients alike.

Compliance Checks for the Investment Advisory Sector

In the stringent world of financial services, ensuring the integrity and trustworthiness of employees is paramount to maintaining industry stability and protecting clients’ interests. Background checks in financial services, including banking background verification, are integral components of this process. Financial industry compliance checks extend beyond basic employment eligibility verifications to include thorough screening for past convictions, as mandated by regulatory bodies worldwide. These stringent measures are designed to safeguard the sector against fraud and other illicit activities, ensuring that investment advisors maintain the highest ethical standards.

Compliance checks for the investment advisory sector involve meticulous scrutiny of an individual’s history, encompassing criminal records, financial misconduct, and any potential red flags that could compromise client assets. Financial employee screening plays a pivotal role in preventing fraudulent practices within the industry. By implementing robust background verification processes, financial institutions can mitigate risks, uphold their regulatory obligations, and foster public confidence in the market. Effective screening methods act as a crucial defense mechanism against malicious actors who may attempt to exploit loopholes for personal gain.

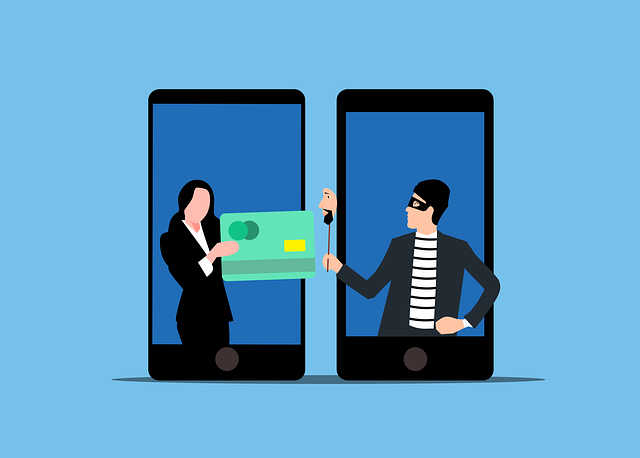

Preventing Fraud: A Crucial Element in Financial Sector Security

Preventing fraud is a paramount concern within the financial sector, making comprehensive background checks an indispensable tool for safeguarding industry integrity. Financial employee screening, including thorough banking background verification, plays a pivotal role in ensuring compliance with regulatory standards and mitigating potential risks. Every financial professional, from investment advisors to bank officers, handles sensitive information and has access to substantial resources, making them susceptible to unethical behavior if not properly scrutinized.

Rigorous financial industry compliance checks are essential to weed out individuals with past convictions or questionable conduct. Such measures help to establish a culture of trust and transparency, fostering confidence among clients and stakeholders. By implementing robust background screening processes, financial institutions can minimize the risk of fraud, protect their reputation, and maintain stability in an increasingly digital banking landscape.

Best Practices for Comprehensive Financial Industry Background Checks

When conducting background checks in the financial services industry, comprehensive and meticulous screening is paramount to ensure the integrity and security of the sector. Financial employee screening should involve a multi-faceted approach, encompassing both traditional and advanced verification methods. Start by thoroughly reviewing criminal records through specialized banking background verification platforms, focusing on offenses related to fraud, embezzlement, or any other illicit activities. These checks are crucial for identifying potential risks early in the hiring process.

Additionally, conduct thorough financial industry compliance checks, scrutinizing investment advisor backgrounds to ensure they possess the necessary qualifications and certifications. Integrate data from multiple sources, including public records, credit reports, and professional licensing boards, to paint a holistic picture of an applicant’s history. Employ fraud prevention in finance techniques, such as pattern recognition algorithms, to detect any unusual activities or discrepancies. Such robust background verification practices are essential to safeguard the financial sector and maintain public trust.