TL;DR:

Background checks are crucial for maintaining integrity and security within the financial services industry. Financial employee screening goes beyond basic employment verification, encompassing criminal records, educational qualifications, and financial conduct. Banking background verification and financial industry compliance checks are vital to prevent fraud, money laundering, and unethical practices. For investment advisors, thorough background investigations safeguard client interests, uphold ethical standards, and foster public trust in the sector. Robust screening processes act as a first line of defense against threats, ensuring market integrity and stability.

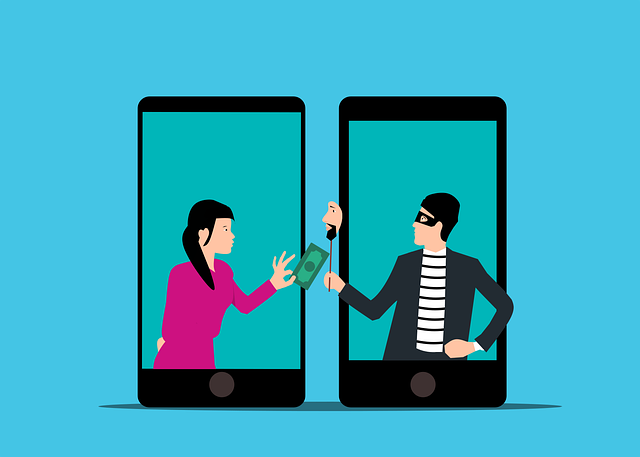

In an era where financial transactions are increasingly digital, ensuring integrity within the sector is paramount. Background checks play a pivotal role in safeguarding against fraud and malfeasance. This article explores the crucial aspects of background verification in the financial domain, focusing on screening employees, enhancing banking security through verification, preventing fraud in compliance checks, and protecting client interests in investment advisory roles. Discover how rigorous background checks fortify the financial sector’s security and maintain public trust.

- The Role of Background Verification in Financial Employee Screening

- Banking Background Verification: Ensuring Trust and Security

- Financial Industry Compliance Checks: Preventing Fraud and Enhancing Integrity

- Investment Advisor Background: Safeguarding Client Interests

- Strengthening Financial Sector Security through Rigorous Background Checks

The Role of Background Verification in Financial Employee Screening

Background verification plays a pivotal role in financial employee screening, ensuring that institutions maintain the highest level of integrity within their workforce. In the financial services industry, where trust and security are paramount, rigorous background checks are essential to safeguard against potential risks, including fraud and regulatory non-compliance. These checks delve into an individual’s employment history, criminal records, educational qualifications, and any other relevant factors to uncover potential red flags that may compromise the integrity of financial operations.

For instance, in the case of investment advisors or bank officers, banking background verification goes beyond basic identity confirmation. It involves comprehensive compliance checks to ensure these professionals have no history of unethical practices, money laundering, or fraud. By implementing robust background screening processes, financial institutions can mitigate risks, protect their clients, and maintain their reputation for integrity within the sector. Effective background verification is, therefore, a game-changer in fostering security and preventing fraudulent activities in finance.

Banking Background Verification: Ensuring Trust and Security

In the dynamic and highly regulated financial sector, background checks play a pivotal role in upholding integrity and safeguarding against potential risks. Banking background verification extends beyond basic employment screening; it involves meticulous processes to ensure the trustworthiness and reliability of every employee. This meticulous scrutiny includes verifying academic credentials, assessing previous employment histories, and uncovering any red flags or discrepancies that could compromise the institution’s security. By implementing robust financial employee screening, banks can mitigate the risk of fraud, money laundering, and other malicious activities, fostering a culture of integrity within the financial industry.

Financial industry compliance checks go hand in hand with background verification. These checks ensure that employees have the necessary qualifications and certifications for their roles, adhering to regulatory standards set by bodies like FINRA or SEC. Moreover, they help identify potential conflicts of interest, links to disreputable entities, or any behavior indicative of unethical practices, thereby strengthening the overall security posture of financial institutions. Protecting clients’ assets and maintaining market integrity depends on continuous vigilance through effective investment advisor background screening, a crucial aspect of fraud prevention in finance.

Financial Industry Compliance Checks: Preventing Fraud and Enhancing Integrity

In the financial sector, where every transaction carries significant weight and security is paramount, thorough background checks are an indispensable tool for maintaining integrity. Financial employee screening involves a meticulous process to ensure that those handling sensitive information and assets do not pose any risks. These checks extend beyond simple verification of identity; they delve into criminal records, employment history, educational qualifications, and financial conduct. By conducting comprehensive banking background verification, institutions can identify potential red flags associated with fraud, money laundering, or unethical practices.

Compliance checks play a pivotal role in preventing fraudulent activities, such as identity theft, embezzlement, and investment scams. Financial industry compliance checks are not just about adhering to regulatory norms but also about safeguarding the interests of clients and the overall stability of financial markets. For instance, background screening of investment advisors ensures that these professionals have the necessary qualifications and a clean record, fostering trust among investors. Effective background verification in financial services forms the first line of defense against potential threats, thereby enhancing the security and reputation of the entire sector.

Investment Advisor Background: Safeguarding Client Interests

Investment Advisor Background: Safeguarding Client Interests

In the realm of financial services, especially with investment advisory roles, thorough background checks are non-negotiable. Financial employee screening goes beyond basic qualifications to encompass a comprehensive review of an advisor’s history, reputation, and potential red flags. Banking background verification ensures that those managing client assets have no significant links to fraud, money laundering, or other illicit activities. Compliance checks in the financial industry are pivotal for maintaining integrity, as they help prevent unethical behavior and protect investors.

An investment advisor’s background is a crucial aspect of fraud prevention in finance. Rigorous screening processes act as a shield, safeguarding client interests by weeding out individuals with questionable pasts. These measures contribute to the overall security of the financial sector, fostering trust among investors who rely on advisors to navigate complex markets while upholding ethical standards.

Strengthening Financial Sector Security through Rigorous Background Checks

In the dynamic and highly regulated financial sector, strengthening security through rigorous background checks is non-negotiable. Financial employee screening plays a pivotal role in ensuring that individuals with access to sensitive data and critical operations meet the highest standards of integrity and competence. Banking background verification processes help uncover potential red flags, such as previous fraudulent activities, legal issues, or unethical behavior, which could pose significant risks to financial institutions and their clients.

Implementing robust financial industry compliance checks, including thorough investment advisor background investigations, is essential for fraud prevention in finance. These checks act as a crucial defense mechanism against insider threats, money laundering schemes, and other malicious activities that can undermine the stability of financial markets. By integrating advanced screening methods, financial institutions can maintain their integrity, protect customer assets, and foster public trust in the sector.