Thorough background screening of investment advisors is crucial to mitigate financial misconduct risks. Verifying qualifications, licenses, education, employment history, and checking for disciplinary actions, lawsuits, and criminal records helps maintain a transparent, secure investment environment and protects client assets in the digital age. Regular screenings foster transparency, accountability, and informed decision-making, ensuring only trustworthy professionals manage client funds.

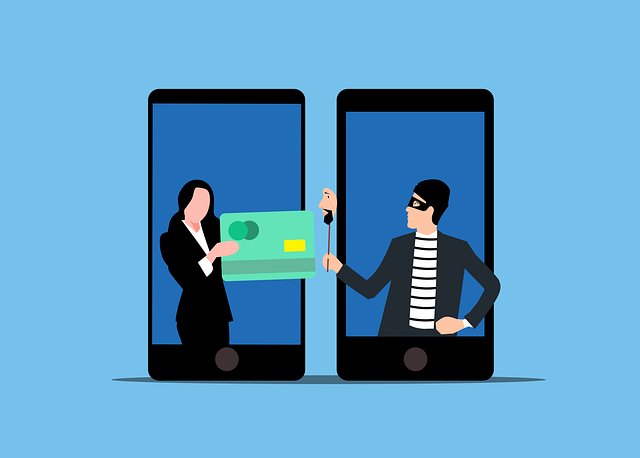

Preventing financial misconduct in the investment advisory industry is paramount to maintaining public trust. With increasing sophistication of fraudulent schemes, robust background screening is an indispensable tool for identifying potential risks early. This article explores the critical role of background checks in mitigating risks associated with financial misconduct among investment advisors. We delve into understanding common risk factors, best practices for comprehensive screening, and essential steps to ensure a secure investment environment.

- Understanding Financial Misconduct Risks in Investment Advisors

- The Role of Background Screening in Risk Mitigation

- Best Practices for Comprehensive Background Checks on Advisors

Understanding Financial Misconduct Risks in Investment Advisors

Financial misconduct among investment advisors can pose significant risks to clients and the industry as a whole. Understanding these potential threats is crucial for identifying and mitigating vulnerabilities. Investment advisor background screening plays a pivotal role in this process, serving as a critical defense mechanism against fraudulent activities. By delving into an advisor’s history, including their educational background, professional experience, and any disciplinary actions or legal issues, financial institutions can assess the potential risks associated with their operations.

Misconduct can take various forms, from investment fraud and unauthorized transactions to conflicts of interest and inadequate disclosure. Given the complex nature of financial markets and the increasing sophistication of fraudulent schemes, it’s essential for advisors to undergo rigorous background checks. These screenings enable regulators and institutions to make informed decisions, ensuring that only trustworthy professionals manage client assets, thereby fostering a more transparent and secure investment environment.

The Role of Background Screening in Risk Mitigation

Background screening plays a pivotal role in risk mitigation for financial institutions, especially when it comes to investment advisors. By thoroughly vetting potential or existing employees, firms can significantly reduce the risk of financial misconduct. This process involves verifying identities, checking employment history, and uncovering any red flags that might indicate unethical behavior or a propensity for fraud. An investment advisor background check is not just about confirming qualifications; it’s about ensuring the integrity of the financial ecosystem.

Regular background screenings act as a robust defense mechanism, allowing institutions to make informed decisions. This practice helps maintain public trust by weeding out individuals with a history of misconduct, thus fostering a culture of transparency and accountability. In today’s digital age, where financial transactions are more accessible, this preventative measure is crucial in safeguarding client assets and upholding the integrity of the industry.

Best Practices for Comprehensive Background Checks on Advisors

When conducting background checks on investment advisors, a thorough and comprehensive approach is paramount in preventing financial misconduct. The process should encompass a multi-faceted screening strategy to uncover potential red flags. Start by verifying the advisor’s qualifications, licenses, and educational background through reputable databases. This initial step sets a solid foundation for gauging their expertise.

Subsequently, delve into their employment history, focusing on previous roles within the financial industry. Cross-referencing these records with customer complaints or disciplinary actions reported to regulatory bodies is essential. Additionally, checking for any civil lawsuits, criminal records, or bankruptcy filings can reveal significant discrepancies. Integrating these best practices ensures that potential risks are identified early, allowing for proactive measures to safeguard investors from unethical conduct.