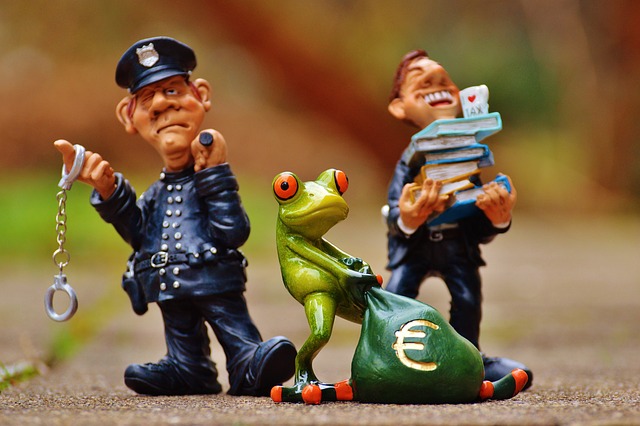

In the financial services industry, rigorous employee screening through comprehensive background checks is crucial for maintaining trust and integrity. These checks go beyond traditional employment history to include financial industry compliance history, investment advisor backgrounds, and banking histories, helping employers make informed decisions, protect client assets, prevent fraud, and maintain sector security, thereby reinforcing its reputation for integrity. Keywords: Background Checks in Financial Services, Banking Background Verification, Financial Industry Compliance Checks, Investment Advisor Background, Fraud Prevention in Finance, Financial Sector Security

In the realm of financial services, where every decision carries significant weight and sensitive data is paramount, rigorous employee screenings are non-negotiable. The industry’s regulatory landscape demands meticulous background checks to safeguard client privacy and prevent fraudulent activities. This article delves into the crucial aspects of financial employee screening, exploring why stringent processes are essential, the comprehensive steps involved, and how they act as a robust defense against fraud while bolstering sector security.

- The Significance of Background Checks in Financial Services

- – The need for stringent screening in a regulated environment

- – Protecting sensitive financial data and client privacy

The Significance of Background Checks in Financial Services

In the financial services industry, where trust and integrity are paramount, robust employee screening is non-negotiable. Background checks play a pivotal role in ensuring the security and compliance of this critical sector. These checks go beyond verifying basic employment history to uncover potential red flags that could indicate fraud, ethical lapses, or other risks associated with an individual’s past. By delving into an applicant’s financial industry compliance history, investment advisor background, and banking background verification, employers can make informed decisions that safeguard the integrity of their institutions and protect clients’ assets.

Rigorous background screenings are a powerful tool in fraud prevention in finance. They help to identify individuals with a history of financial misconduct or those who have been involved in previous scams, ensuring they do not gain access to sensitive information. Moreover, these checks contribute to maintaining the overall security of the financial sector by weeding out potential threats and fostering an environment where trust is earned and upheld, reinforcing the industry’s reputation for integrity.

– The need for stringent screening in a regulated environment

In the highly regulated financial services industry, where even minor lapses can lead to significant consequences and reputational damage, rigorous employee screening is non-negotiable. Background checks for financial employees, including banking professionals, investment advisors, and other financial sector roles, play a crucial role in ensuring compliance, safeguarding customer assets, and mitigating fraud risks. Financial institutions must delve into comprehensive background verification processes that extend beyond traditional employment screening to uncover potential red flags or undisclosed information that could compromise the integrity of the organization and its clients.

Effective financial employee screening involves meticulous investment advisor background checks, thorough credit history reviews, and verification of educational credentials and professional certifications. Moreover, these checks should encompass an examination of past employment records, criminal history (if any), and potential conflicts of interest. Such comprehensive banking background verification is essential to foster a secure financial landscape, protect the interests of investors, and maintain public trust in the industry.

– Protecting sensitive financial data and client privacy

In the financial services industry, where trust and security are paramount, rigorous employee screening is non-negotiable. Background checks play a pivotal role in safeguarding sensitive financial data and client privacy, which are the lifeblood of this sector. Thorough verification processes ensure that only trustworthy individuals with clean records gain access to confidential information. Financial institutions employ comprehensive background check procedures, including banking background verification and compliance checks, as a robust defense against potential insider threats and fraud.

When it comes to financial industry security, protecting client data is not just about technology; it’s equally about the people handling it. Screening prospective employees involves delving into their past employment, education, and any relevant licenses or certifications. This meticulous process helps identify individuals with a history of ethical conduct and a commitment to upholding the highest standards of integrity. Additionally, regular updates on these checks ensure that any changes in an employee’s background are promptly detected, fostering a culture of ongoing compliance and fraud prevention in finance.