In the highly regulated financial sector, where security is paramount, screening financial professionals for criminal history has become crucial to prevent fraudulent activities. Background checks, facilitated by legal frameworks and regulations, help identify individuals with a history of crimes like fraud, embezzlement, or money laundering. This meticulous process includes gathering personal data, verifying employment history, checking educational credentials, and reviewing criminal records. Powered by AI-integrated digital platforms, biometric authentication, and multi-factor security, these measures enhance fraud prevention and safeguard sensitive data, fostering public confidence in the sector's integrity.

In the highly regulated financial sector, ensuring robust security is paramount. One critical aspect often overlooked is screening financial professionals for criminal history. With increasing instances of white-collar crime, it’s imperative to understand the legal framework and regulations governing background checks. This article guides you through the process of screening these professionals, offers best practices, and explores emerging technologies for enhanced security in the financial sector.

- Understanding the Need for Criminal History Screening in the Financial Sector

- Legal Framework and Regulations Governing Background Checks

- The Process of Screening Financial Professionals: Step-by-Step Guide

- Best Practices and Emerging Technologies for Enhanced Security

Understanding the Need for Criminal History Screening in the Financial Sector

In the dynamic and highly regulated financial sector, ensuring security is paramount. One critical aspect often overlooked but increasingly vital is screening financial professionals for criminal history. With the potential impact of fraudulent activities on investors and the stability of financial institutions, it’s crucial to implement robust background checks. These screenings serve as a protective measure against individuals with a history of crimes like fraud, embezzlement, or money laundering, who could pose significant risks to the integrity of the sector.

The need for criminal history screening is driven by the financial sector’s sensitivity to potential security breaches. As financial professionals have access to substantial resources and sensitive client data, any untoward behavior in their past can raise red flags. Regular and thorough screenings help identify such individuals early, allowing for proactive measures to mitigate risks and maintain the high standards of integrity expected in the financial industry.

Legal Framework and Regulations Governing Background Checks

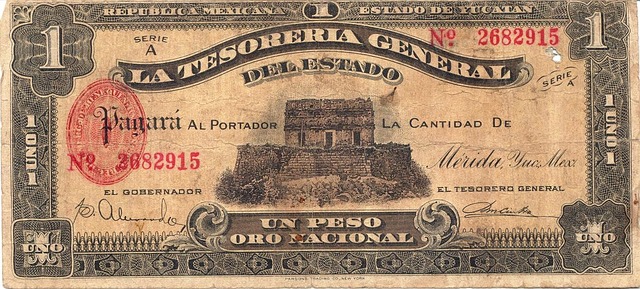

In the financial sector, maintaining security and integrity is paramount. Background checks play a crucial role in ensuring that criminal histories of financial professionals are thoroughly vetted. Legal frameworks and regulations across various jurisdictions have been established to facilitate these checks, with the primary goal of protecting investors, clients, and the overall stability of financial institutions.

These regulations often mandate that firms conducting business within their borders conduct comprehensive background screenings on employees, especially those in positions of trust and responsibility. This includes verifying employment history, educational credentials, and most significantly, checking for any criminal records or pending legal issues. Adherence to these guidelines is not just a legal necessity but also helps foster public confidence in the financial sector’s integrity.

The Process of Screening Financial Professionals: Step-by-Step Guide

Screening financial professionals for criminal history involves a meticulous process designed to ensure the integrity and security of the financial sector. It begins with gathering comprehensive personal data, including employment history and educational qualifications. This initial step is crucial for identifying relevant records and establishing a baseline for further investigation.

Next, a thorough background check is conducted, leveraging specialized databases and public records. This includes verifying identities, checking for any previous arrests or convictions, and scrutinizing financial transactions for anomalies. Additionally, references from past employers or clients are contacted to gain insights into the professional’s conduct and character. By integrating these steps, the process offers a comprehensive view, enabling informed decisions in maintaining the high standards of security sought within the financial sector.

Best Practices and Emerging Technologies for Enhanced Security

In the ever-evolving landscape of financial sector security, best practices and emerging technologies play a pivotal role in safeguarding against criminal activities. One of the primary measures involves conducting thorough background checks, including screening for criminal history, when onboarding new financial professionals. Advanced digital platforms equipped with artificial intelligence (AI) capabilities now facilitate this process by seamlessly integrating data from various sources, such as national crime databases and public records. These tools enable efficient verification of identities and historical conduct, thereby mitigating risks associated with insider threats and fraud.

Additionally, biometrics and multi-factor authentication methods are transforming financial sector security. Biometric data, like fingerprints or facial recognition, offers an unparalleled level of protection by ensuring that only authorized individuals can access sensitive information. Meanwhile, implementing robust multi-factor authentication protocols adds an extra layer of defense, making it significantly harder for unauthorized parties to breach security. These emerging technologies, when combined with stringent policy frameworks and ongoing employee training, contribute to a comprehensive strategy for enhancing financial sector security.