Background checks in financial services are paramount for employee screening, preventing fraud, identity theft, and cyberattacks by verifying identities, assessing past conduct, and identifying risks. Robust procedures include examining employment, education, and legal records, fostering transparency and accountability to safeguard sensitive data and transactions within the competitive, regulated financial sector.

In today’s digital age, enhancing security in financial services is paramount. As the financial landscape evolves, so do the threats, necessitating robust measures to safeguard sensitive data and transactions. This article delves into the critical role of background checks as a cornerstone of financial employee screening. We explore the diverse types of checks, from criminal history to financial integrity assessments, and provide insights on implementing effective security check systems tailored for the dynamic financial services sector.

- Understanding the Financial Services Landscape and Security Threats

- The Role of Background Checks in Employee Screening

- Types of Checks: From Criminal to Financial Integrity

- Implementing and Effectively Using Security Check Systems

Understanding the Financial Services Landscape and Security Threats

The financial services landscape is a complex web of institutions, from banks and credit unions to investment firms and insurance companies, all handling sensitive data and transactions. This dynamic environment presents unique security challenges due to the high value of assets at risk and the stringent regulatory requirements. Background checks play a pivotal role in financial employee screening, serving as a foundational layer of defense against potential threats.

Security threats in this sector range from fraud and identity theft to money laundering and cyberattacks. Malicious actors may attempt to infiltrate systems, manipulate data, or steal confidential information. By implementing robust background check procedures, financial institutions can mitigate these risks by verifying the identities of employees, assessing their past conduct, and uncovering any potential red flags that could compromise security.

The Role of Background Checks in Employee Screening

In the realm of financial services, where security and trust are paramount, background checks play a pivotal role in employee screening. These rigorous processes extend far beyond basic verification, delving into an applicant’s history to uncover potential red flags or discrepancies that could compromise the integrity of the organization. By leveraging comprehensive background checks, financial institutions can mitigate risks associated with fraud, embezzlement, and other security breaches.

During financial employee screening, background checks serve as a crucial filter, ensuring that only trustworthy individuals gain access to sensitive data and critical infrastructure. They involve meticulous scrutiny of an applicant’s employment history, educational qualifications, and any relevant legal or regulatory issues. This holistic approach not only safeguards the institution but also fosters a culture of transparency and accountability among employees, thereby enhancing overall security in financial services.

Types of Checks: From Criminal to Financial Integrity

In the realm of financial services, enhancing security through checks is paramount. Among various types, background checks stand out as a crucial component of financial employee screening. These thorough investigations delve into an individual’s past, examining criminal records, employment history, and financial integrity. By conducting comprehensive background checks, financial institutions can mitigate risks associated with fraud, embezzlement, and other malicious activities that could compromise sensitive financial data.

Beyond ensuring criminal integrity, these checks also focus on verifying the financial stability and reliability of prospective employees. This involves scrutinizing credit histories, previous employers’ references, and any red flags that might suggest unethical behavior. Such holistic approaches to background screening foster a culture of trust and transparency within financial organizations, ultimately bolstering their security posture in today’s digital era.

Implementing and Effectively Using Security Check Systems

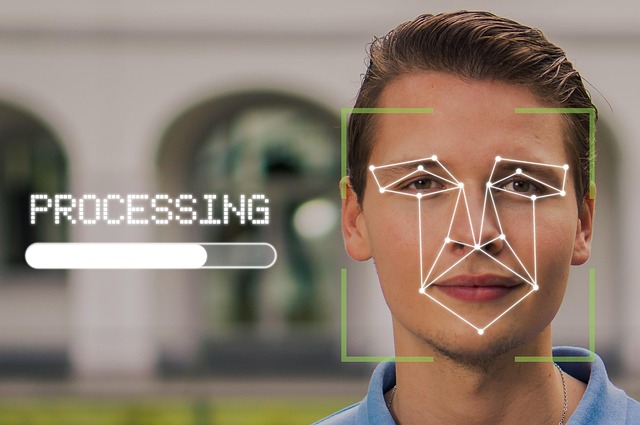

Implementing robust security check systems is a cornerstone of enhancing security in financial services. Background checks in financial services, particularly financial employee screening, play a pivotal role in mitigating risks and ensuring compliance. These checks involve verifying identities, assessing past employment history, and uncovering any potential red flags that could indicate fraud or unethical behavior. By integrating comprehensive screening processes, financial institutions can create a defensive layer against internal and external threats.

Effective use of these systems requires ongoing maintenance and updates. Financial institutions should regularly review and expand their security protocols to keep pace with evolving criminal tactics and regulatory requirements. Additionally, training employees on the importance of data accuracy and maintaining confidentiality during the checking process is crucial for fostering a culture of security awareness throughout the organization.