In the digital age, the financial sector faces heightened cybersecurity risks from advanced fraud and cybercrime. To counter these threats, institutions heavily invest in stringent background checks, protecting sensitive data, preventing unauthorized access, and mitigating money laundering. Streamlined, automated processes powered by advanced technologies enhance security, streamline operations, and build customer trust. Proven success stories from leading institutions demonstrate the vital role of robust background checks in safeguarding both entities and fostering integrity within the financial industry.

Financial institutions are increasingly recognizing the critical importance of thorough background checks in safeguarding their operations and clients. As the financial sector becomes a prime target for fraud, money laundering, and data breaches, robust background verification processes are essential. This article explores the rising need for stringent background checks, highlighting how they protect sensitive data, mitigate risks, ensure regulatory compliance, and streamline security processes. Through case studies, we demonstrate that comprehensive background check systems are game-changers in enhancing financial sector security.

- The Rising Need for Thorough Background Checks in the Financial Sector

- Protecting Sensitive Data: A Key Role of Background Verification

- Mitigating Risks: How Background Checks Prevent Fraud and Money Laundering

- Regulatory Compliance and Its Impact on Financial Institution Operations

- Streamlining the Process: Efficient Background Check Systems for Better Security

- Case Studies: Success Stories of Background Checks in Enhancing Financial Sector Security

The Rising Need for Thorough Background Checks in the Financial Sector

In today’s digital era, the financial sector faces unprecedented challenges in maintaining robust security. As fraud and cybercrime become increasingly sophisticated, financial institutions are realizing the critical importance of thorough background checks to safeguard their operations and clients’ assets. The rising complexity of global markets and the ease of access to sensitive financial information have opened doors for malicious actors, making it imperative to implement stringent verification processes.

Background checks play a pivotal role in ensuring the integrity of the financial sector. By verifying the identity, credentials, and past activities of individuals involved in transactions or seeking employment, institutions can mitigate risks effectively. This is particularly crucial when dealing with high-value transactions, sensitive data, and roles that require access to critical infrastructure. Financial institutions are now investing heavily in advanced screening technologies and data analytics to stay ahead of evolving threats, ensuring a secure environment for all participants.

Protecting Sensitive Data: A Key Role of Background Verification

In the financial sector, where every transaction and interaction involves sensitive data, protecting this information is paramount. Background verification plays a crucial role in ensuring the security of financial institutions by thoroughly screening individuals who have access to such data. This process helps prevent unauthorized access, fraud, and identity theft, which could lead to significant financial losses for both institutions and their clients.

By conducting comprehensive background checks, financial entities can verify an individual’s identity, assess their risk profile, and confirm their credibility. This includes verifying employment history, checking references, and examining criminal records. Such measures fortify the institution’s defenses against malicious activities, ensuring that sensitive data remains secure and confidential.

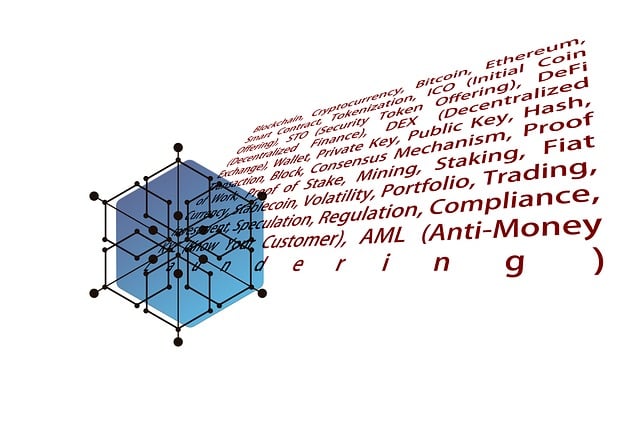

Mitigating Risks: How Background Checks Prevent Fraud and Money Laundering

Background checks play a pivotal role in bolstering financial sector security by acting as a robust shield against fraud and money laundering. These meticulous processes scrutinize an individual’s history, including their employment, education, and financial transactions, to unearth any potential red flags or suspicious activities. By employing advanced verification techniques and cross-referencing data from multiple sources, financial institutions can significantly mitigate risks associated with illicit practices.

The implementation of thorough background checks serves as a crucial deterrence for fraudulent schemes, as it becomes exceedingly challenging for criminals to impersonate individuals or access sensitive financial information. Furthermore, these checks help identify any links to known money laundering networks, enabling proactive measures to disrupt illegal funding operations. As the financial sector continues to evolve in an increasingly digital landscape, maintaining robust security standards through comprehensive background investigations remains paramount to safeguarding transactions and protecting the integrity of the global economy.

Regulatory Compliance and Its Impact on Financial Institution Operations

Regulatory compliance is a cornerstone in the financial sector, playing a pivotal role in ensuring the stability and integrity of institutions and their operations. With strict guidelines and standards set by governing bodies, financial institutions are required to conduct thorough background checks on individuals involved in various capacities, from employees to clients. This meticulous process is not merely a box-ticking exercise but a critical component in mitigating risks associated with fraud, money laundering, and other illicit activities.

The impact of regulatory compliance extends beyond risk management, significantly influencing the day-to-day operations of financial institutions. Efficient background check procedures streamline processes like onboarding new hires, opening business accounts, and facilitating transactions, ensuring that these activities are conducted smoothly while adhering to legal frameworks. This emphasis on security measures not only safeguards the institution but also instills public confidence in the overall financial sector.

Streamlining the Process: Efficient Background Check Systems for Better Security

In today’s digital age, streamlining background check processes is crucial for maintaining robust financial sector security. Efficient systems play a pivotal role in verifying identities, preventing fraud, and mitigating risks associated with suspicious activities. By implementing advanced technologies and data analytics, financial institutions can significantly enhance their due diligence, ensuring compliance with regulatory standards while saving time and resources.

Automated background check platforms offer unparalleled speed and accuracy, enabling institutions to conduct thorough screenings on applicants for jobs, loans, or other financial services. These systems seamlessly integrate various data sources, including public records, credit reports, and international databases, providing a comprehensive view of an individual’s history. As a result, financial sector security is bolstered, fostering trust among customers while deterring malicious actors from exploiting vulnerabilities.

Case Studies: Success Stories of Background Checks in Enhancing Financial Sector Security

Background checks have become an indispensable tool in enhancing financial sector security, with numerous success stories across various institutions. One notable case involves a leading investment bank that implemented stringent background screening processes for all employees and contractors. This proactive measure led to the early detection of several potential internal threats, including insider trading attempts and fraudulent activities. By verifying individuals’ identities, employment histories, and credentials, the bank significantly reduced its exposure to financial losses and maintained the integrity of its operations.

Another success story comes from a regional credit union that faced increasing instances of identity theft and fraud. They invested in advanced background check technology, which included social security number verification, criminal records checks, and address history reviews. This comprehensive approach resulted in the rejection of numerous fraudulent applications, saving the credit union millions in potential bad loans. The improved financial sector security not only protected the institution but also enhanced customer trust, demonstrating that robust background checks are a critical component in mitigating risks within the financial industry.